iowa inheritance tax rates 2021

Pre-2021 taxiowagov 60-061 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. Summary 2021-04-09 A bill for an act authorizing future tax contingencies reducing the state inheritance tax rates and providing for the future repeal of the state.

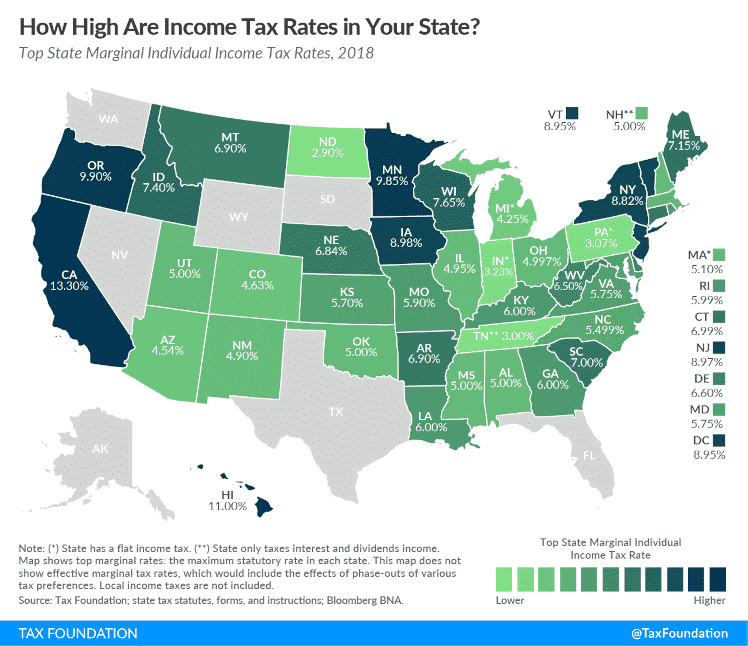

Business Property Taxes Tax Foundation

Ad Learn How to Create a Trust Fund with Wells Fargo Free Estate Planning Checklist.

. The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. Connecticuts estate tax will have a flat rate of 12 percent by 2023. In the meantime there is a phase-out period before the tax completely disappears.

Tax rates range from 18 to 40. Iowa inheritance Tax Rate B 2020. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed.

If you give a single person more. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Federal estate taxes apply to estates worth more than 117 million as of 2021.

Up to 25 cash back Update. The phase-down begins with deaths occurring on or after July 1 2021 with the first of nine annual tax rate reductions. Read more about Inheritance Tax Rates Schedule.

As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out. Wednesday June 16 2021. Iowa Inheritance and Gift Tax.

A summary of the different categories is as follows. Reynolds signed SF 619 into law legislation that cuts taxes and invests significantly in mental health as well as. 619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st.

Register for a Permit. 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20. Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now.

These tax rates are based upon the relationship of. Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. Inheritance Tax Rates Schedule.

Track or File Rent Reimbursement. The phase-down begins with deaths occurring on or after July 1 2021 with the first of nine annual tax rate reductions. Iowa Inheritance Tax Rates.

Iowa is phasing out its. If the net value of. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

If the net estate of the decedent found on line 5 of IA. DES MOINES - Today Gov. 2021 taxiowagov 60-062 05312022.

The inheritance tax and the qualified use inheritance. Inheritance Tax Rates Schedule. The federal gift tax has a 15000 per year exemption for each gift recipient in 2021 and 16000 in 2022.

On May 19th 2021 the Iowa Legislature similarly passed SF. In 2021 Iowa decided to repeal its inheritance tax by the year 2025. Change or Cancel a Permit.

Iowa Inheritance Tax Rates. For more information on the limitations of the inheritance tax clearance see Iowa. Get Your Free Estate Planning Checklist and Start Developing a Plan Today.

Iowa has decided to end their inheritance tax starting in 2021 and will completely abolish the tax by January 1st 2025 between now and then the Iowa Inheritance Tax will reduce by 20 per. The inheritance tax and the qualified use inheritance. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent.

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Iowa Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Iowa Estate Tax Everything You Need To Know Smartasset

2022 Federal State Payroll Tax Rates For Employers

Recent Changes To Iowa Estate Tax 2022

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax